Project Information

- Title: Job to Job Flows and Market Performance

- Tech: Python (PySpark)

- Date: Fall 2022

- Report: View PDF

About

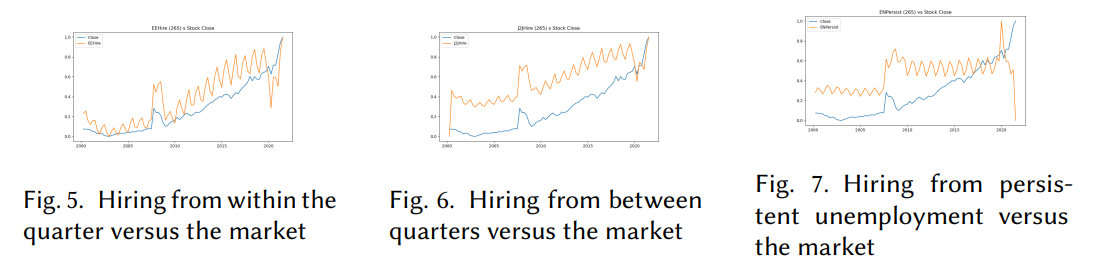

While unemployment is often considered a lagging economic indicator, investors that believe in perfect market efficiency would argue that any economic release, including unemployment, should be immediately reflected in market performance.

Hiring releases should have the same effect. As unemployment rates are already well-studied and there is a vast amount of data available for job-to-job flows in the U.S., I wanted to explore whether it is possible to predict market performance from lagging hiring data.

Using the Granger Causality Test with a Ridge regression (due to the high collinearity of the data), I found up to a 61.11% relation between leading U.S. Federal hiring trends and lagging S&P500 performance quarter over quarter with high statistical significance for all models (p < 0.021).