Project Information

- Title: ESG Dashboard

- Tech: Python (Streamlit, Pandas, Plotly, etc.)

- Date: March 2023 - May 2023

- Dashboard: Interactive Dashboard and Report

About

There is an idea of shared value by Michael Porter that correlates productive environmental governance ingrained into the business model with increased business success. In the social and economic climate of today, we have reason to believe that companies displaying care and concern should have the most success for their stakeholders. At the same time, the effort required to display this care and concern may detract from productivity.

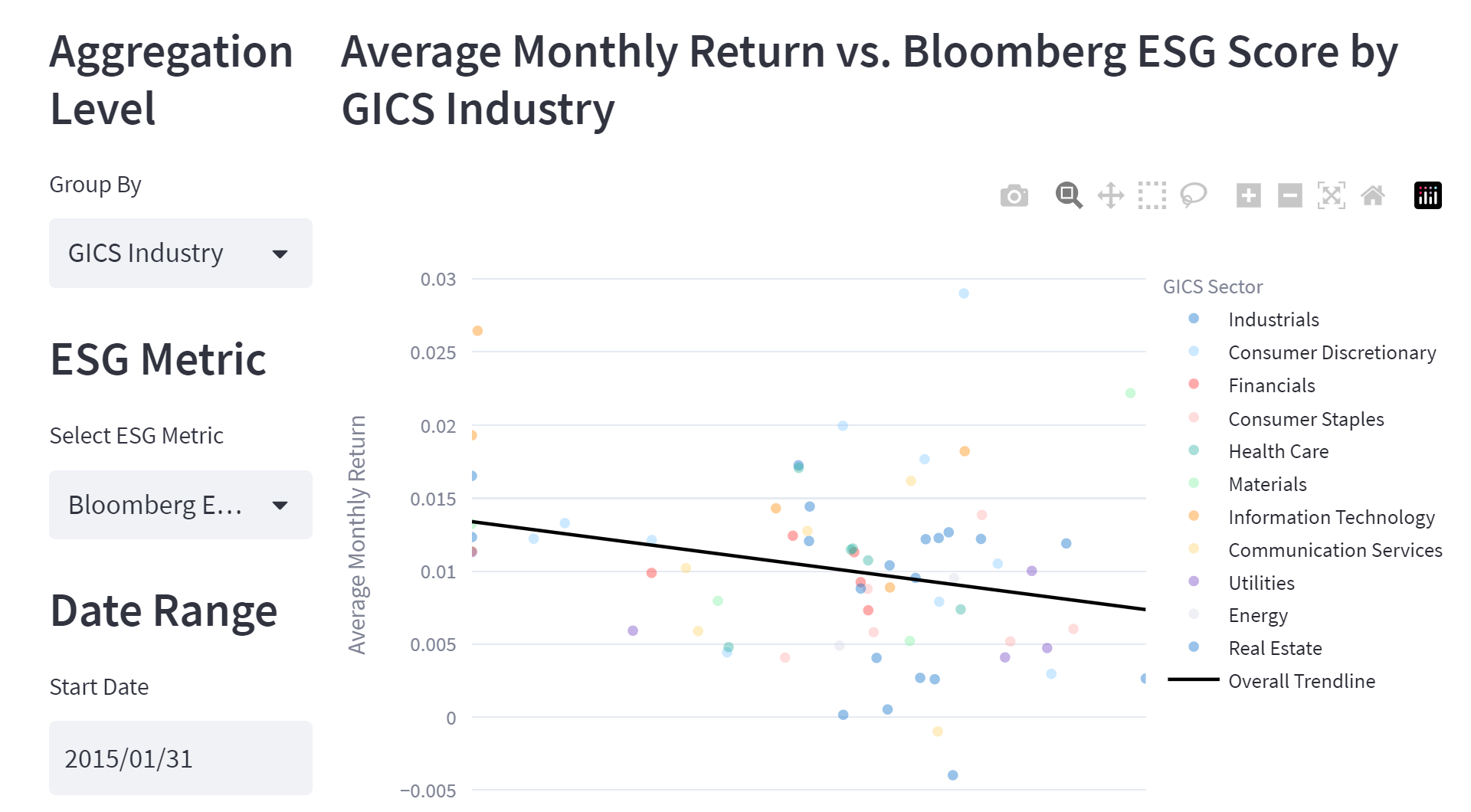

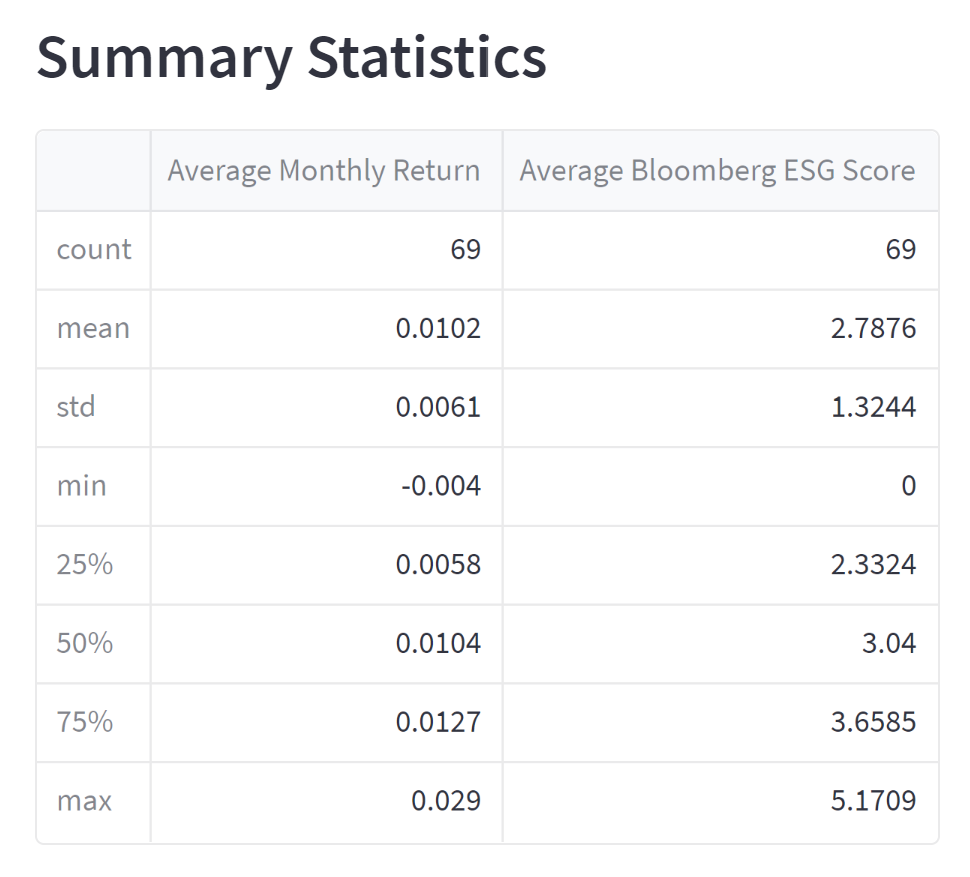

As ESG scores have emerged in the last decade, we now have metrics with which to measure a company's care and concern. By introducing ESG scores as a critical factor in financial performance of a company, we can explore the relationship between shared value (high ESG) and market performance. Though ESG scores have recently come under criticism, our initial hypothesis was that companies with a high focus on ESG have a relatively high company performance over time.

The Big Picture

Has ESG changed the landscape of business? Are ESG metrics correlated with increase company performance?

- Have increasing ESG scores correlated with high or increasing stock returns?

- Can ESG provide any value in predicting performance?

Metrics

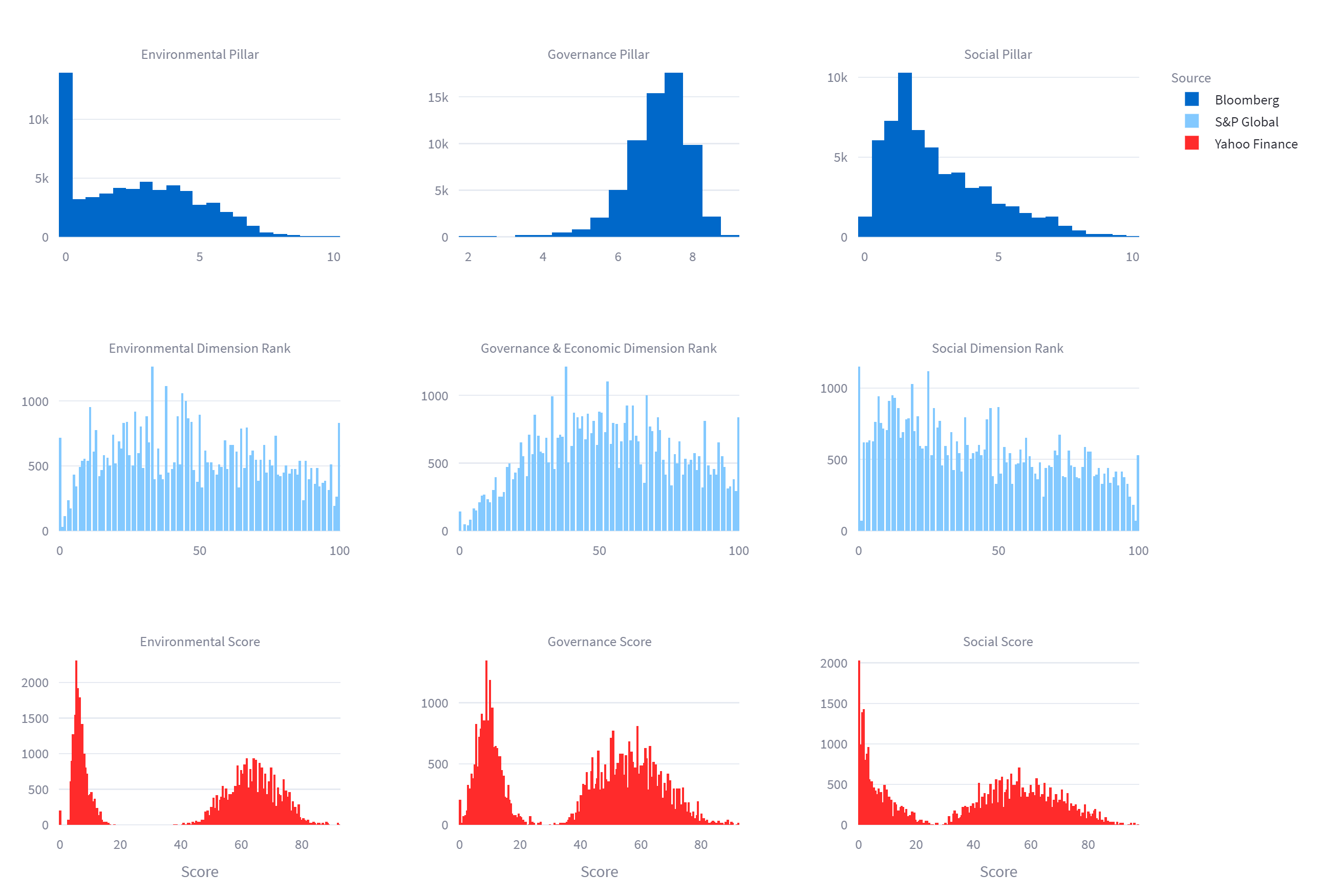

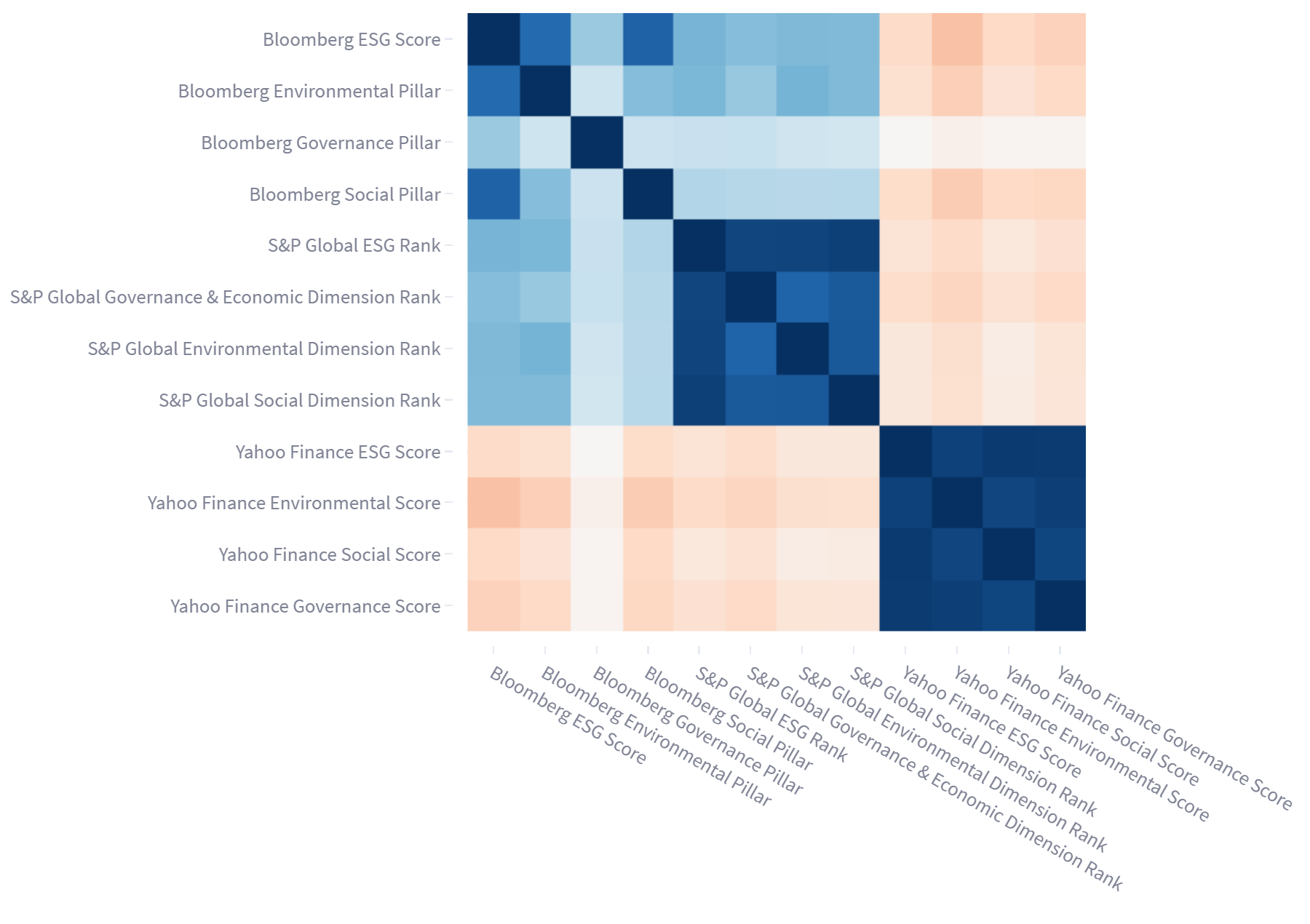

The sources of our ESG metrics are Bloomberg, S&P Global, and Yahoo Finance. All providers give total ESG scores, along with scores for each of the environmental, social, and governance pillars. Bloomberg and Yahoo Finance provide scores where higher values correlate with higher alignment, while S&P Global provides a ranking where lower values correlate with higher alignment.

The Analysis

Details of our models and analysis can be found on the Interactive Dashboard.