Project Information

- Title: AWS Pursuit Loan Chatbot

- Tech: Amazon Lex → Lambda → API → DynamoDB

- Date: June 2021

- Presentation: View Slides

About

In a hackathon-style project, myself and 4 other teammates were tasked with building a helpful banking tool. We had <48 hours to complete the project and presentation.

The Problem

Our chatbot targets millennials who are buying their first homes and cars but don't yet understand how credit will impact cost over time. Millennials are lacking in financial literacy: they are rejected more than any other generation when applying for loans, mortgages, and credit cards, and ~25% of millennials don't even know what a credit score is.

Our Solution

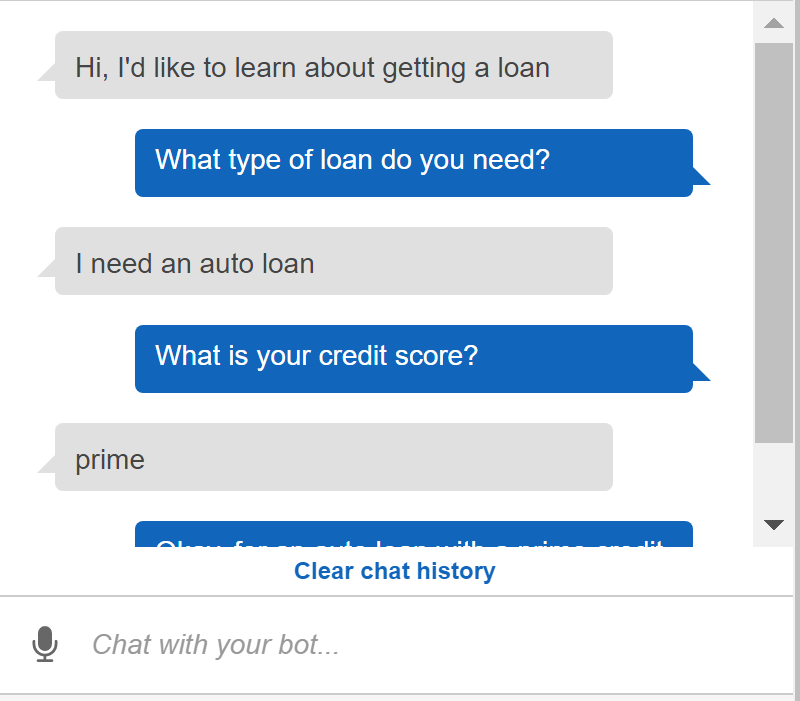

Our solution needed to convert credit scores to loan rates in a way that is interactive, intuitive, and informative.

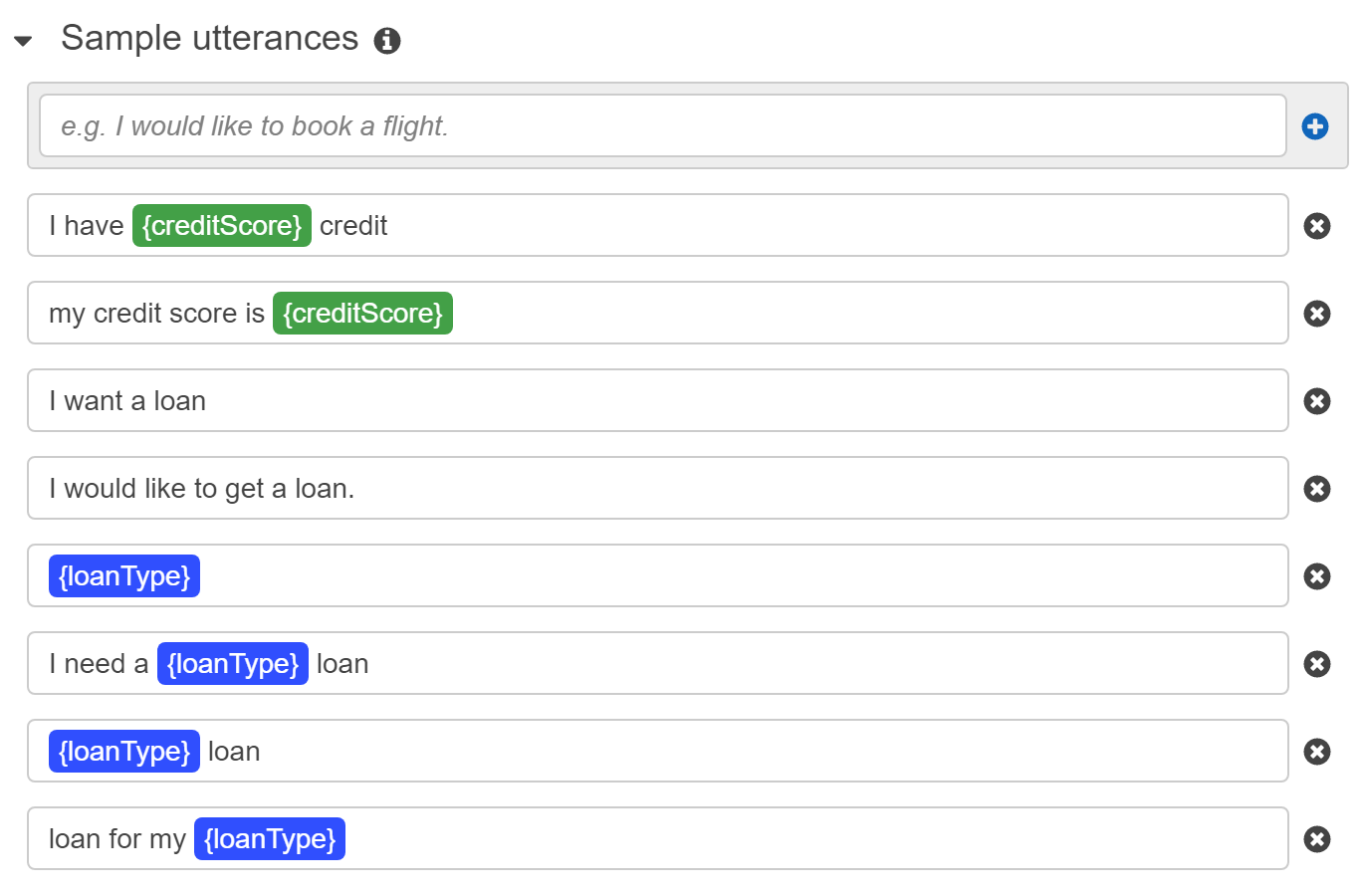

A user starts by interacting with an Amazon Lex bot. The bot gathers information from the interaction to feed into a Node.js Lambda function (a piece of serverless code) that includes the credit score of the user and whether they're planning on getting an auto loan or a mortgage.

This function passes the gathered information onto an API we wrote. Our API retrieves the appropriate loan rate and returns it to the user. If the user's credit score is low, we offer resources on how to improve credit.

For millennials, this chatbot offers a way to interact that is comfortable for them, educational, and offers a quick response time.

For the bank, the bot increases client engagement, saves money on call center operatives and support staff, and increases efficiency, scalability, and reliability due to its cloud architecture.